Commercial loan amortization period

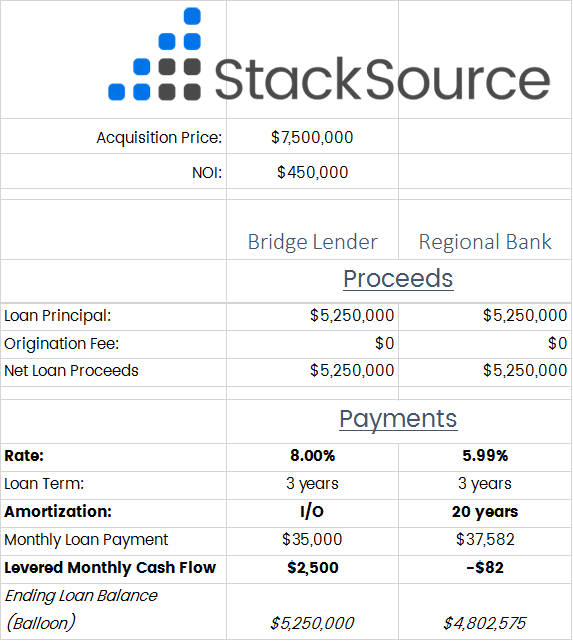

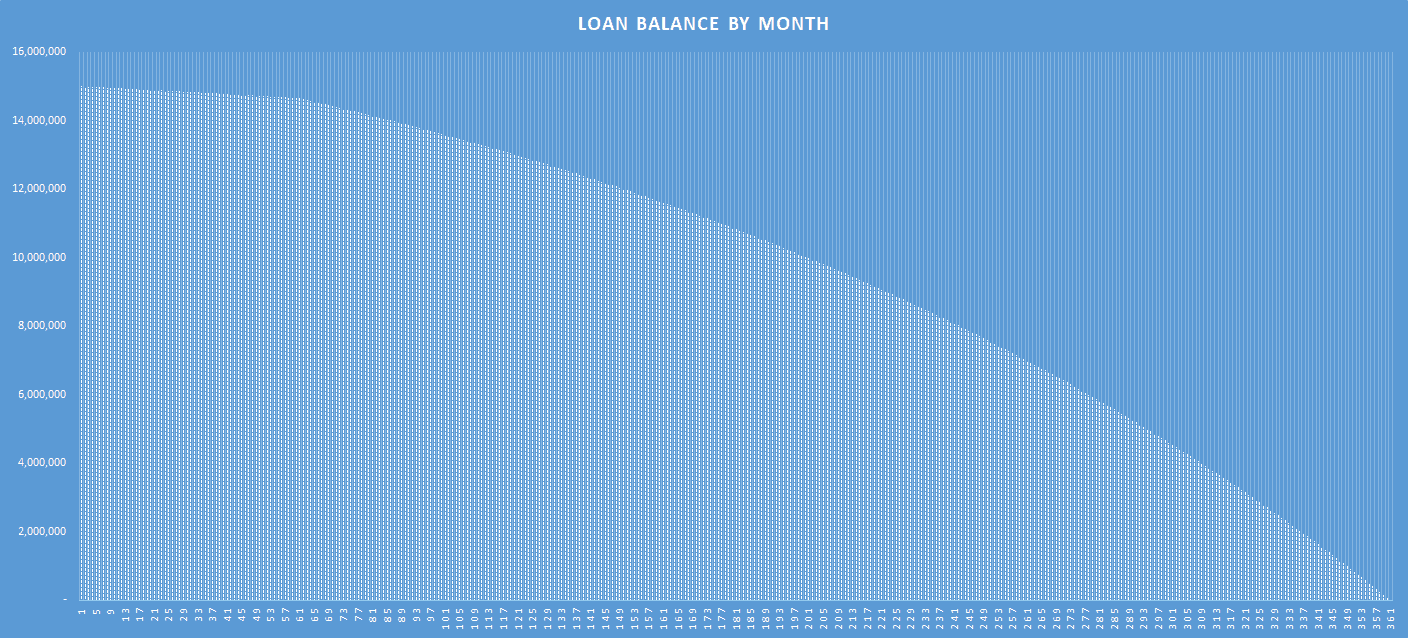

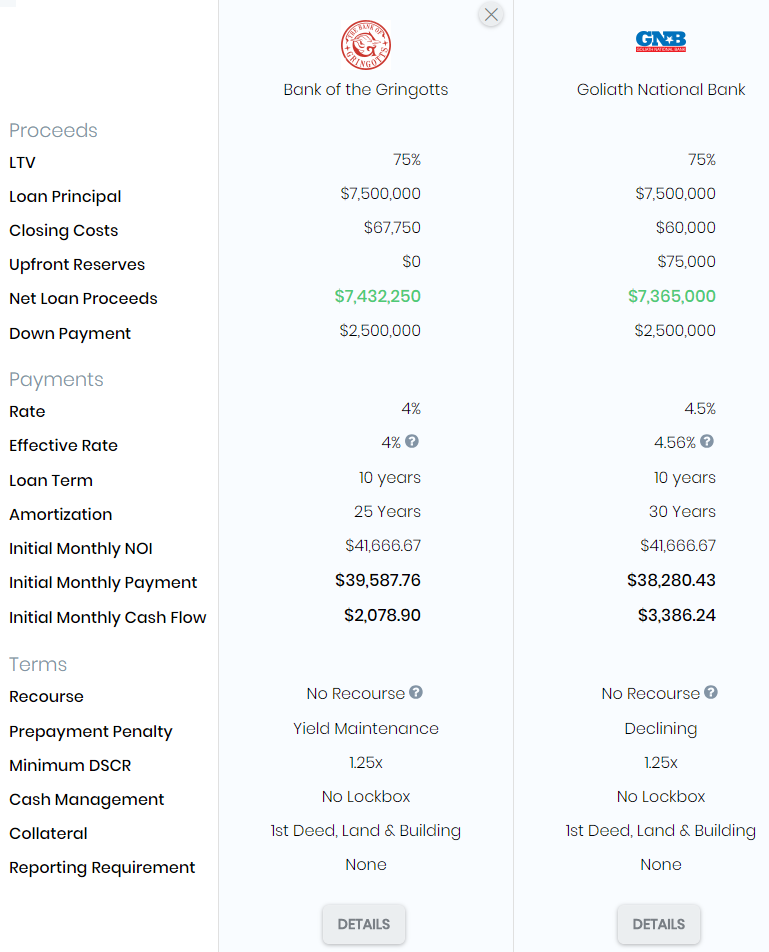

The loan document states the life usually in months. When the amortization period of the loan is longer than the payment term there is a loan balance left at maturity sometimes referred to as a balloon payment.

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is Amortization Schedule

And by the end of the loan term.

. The amortization is based on a 30-year loan but the loan term is 7 years. Commercial loans typically range from five years or less to 20 years with the amortization period often longer than the term of the loan. Amortization period with periodic principal and interest.

Below is an amortization schedule for a business loan of 20000 at a 9 stated or nominal interest rate with a five-year term. Step 2 Amortization of Loan Costs. The commercial loan definition excludes loans secured by a vehicle manufactured for personal family and household use.

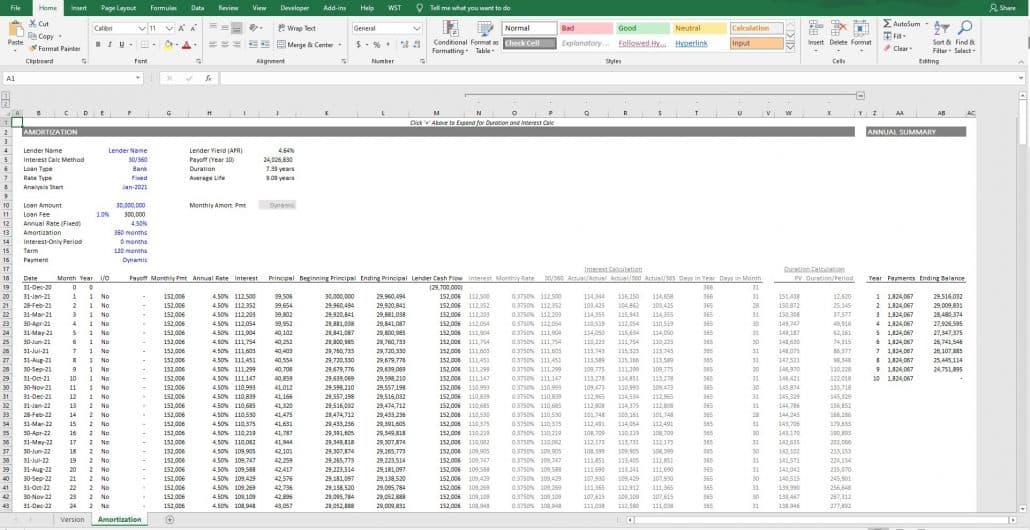

This is the period of time it takes to pay off the loan if regular payments are made and assuming no interest only periods are inputted. 362 rows Use our amortization schedule api to return the schedule and payment summary data. Most loans have a.

187 rows Commercial Loan Amortization Calculator is used to calculate monthly payment for commercial loan payments with balloon payment. Term is the period of time in which its possible to repay the loan making regular payments. The loan is scheduled to be paid off in equal annual.

Generally speaking amortization is the process of paying back a loan in installments over a period of time. Input the amortization period in years. Typically a commercial real estate loan amortization period is between 20-30 years.

What Are Split Amortizations. Most multifamily loans are 30-year amortizations while core commercial loans are 25-year amortizations. The commercial loan calculator is easy to.

Amortization years The duration of most Commercial real estate mortgages varies from five years or less to 20 years and the amortization period is often longer than the term of the. This is a good place to start. Interest rates vary drastically depending on risk.

Our api can have two return types. The borrower makes monthly payments of 8408541 for 7 years. The HTML version will return the HTML table itself while the.

While residential mortgages typically have a 15 or 30-year. Amortization is the length of time it takes a borrower to repay a loan. 44 rows Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with.

An example of split amortization would be a loan with a 5. The costs of the loan are allocated over the life of the loan. If you have a 10.

The Advanced Mortgage Amortization Module Updated Jul 2022 Adventures In Cre

Simple Interest Loan Calculator How It Works

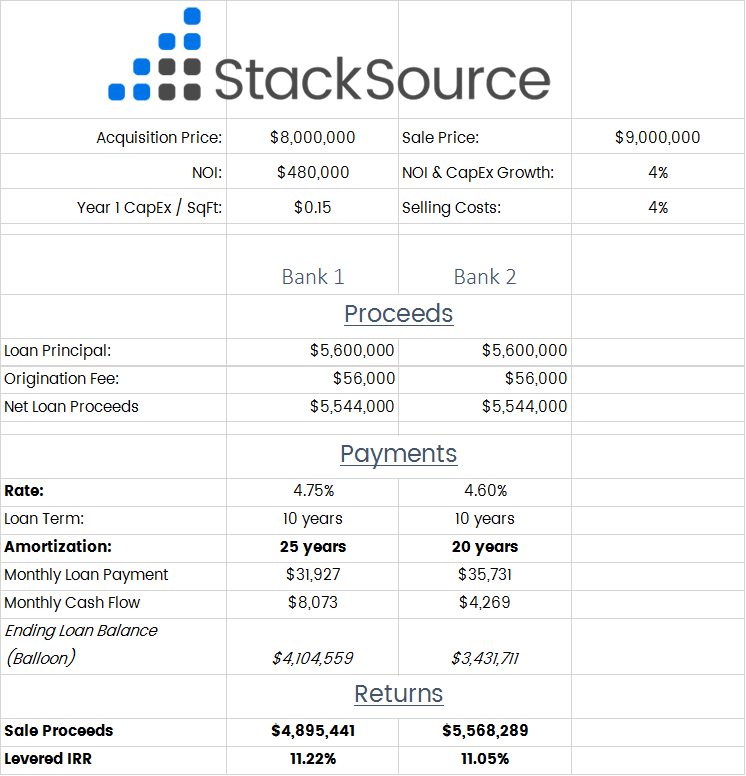

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

Watch Me Build A Mortgage Amortization Table In Excel

Loan Amortization Schedule With Variable Interest Rate In Excel

Adding An Interest Only Period To An Amortization Schedule 1 Of 2 Youtube

Typical Structure Of A Commercial Mortgage Term Sheet By Tim Milazzo Stacksource Blog

5 Things You Need To Know About Amortization Schedules

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

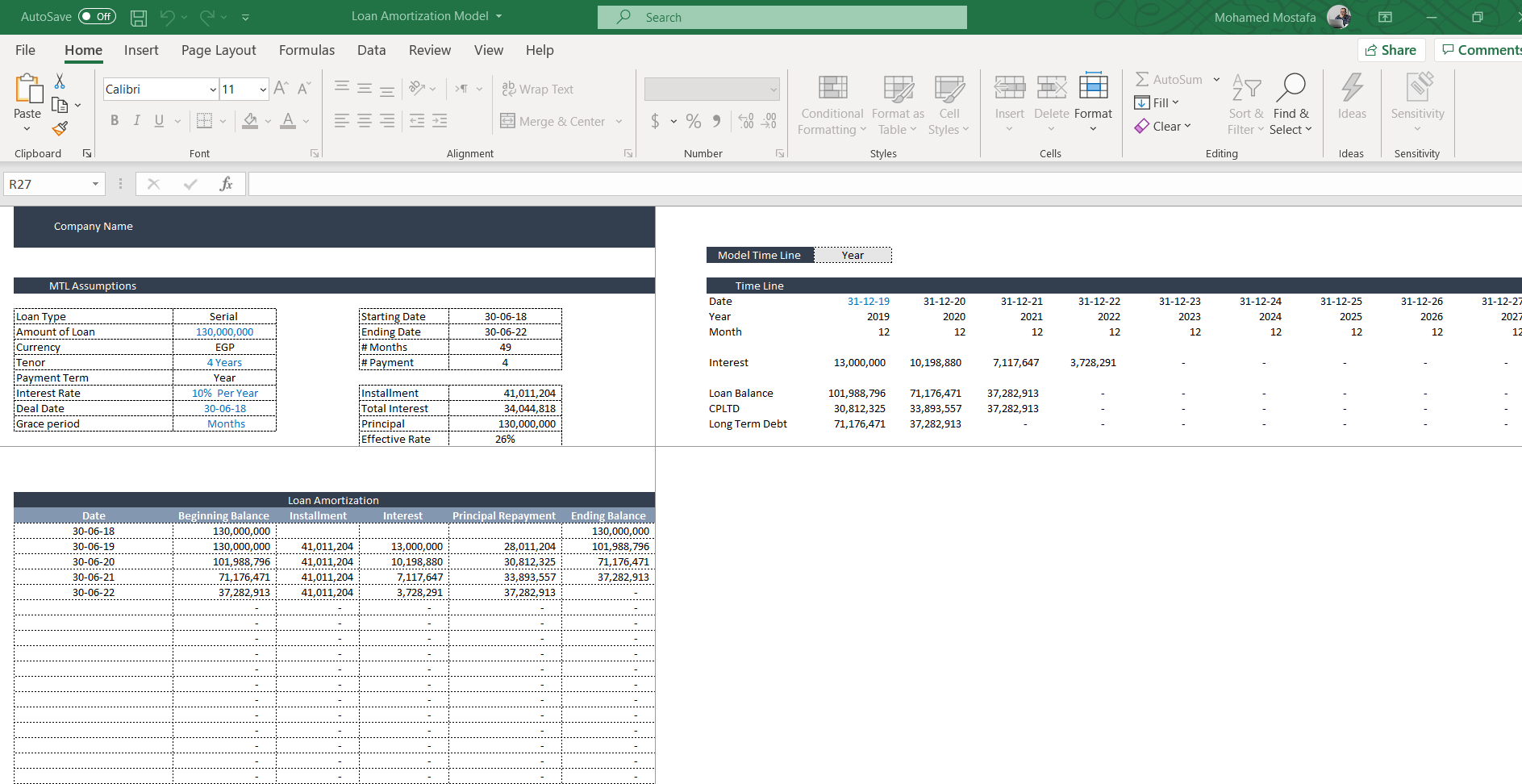

Loan Amortization Model Eloquens

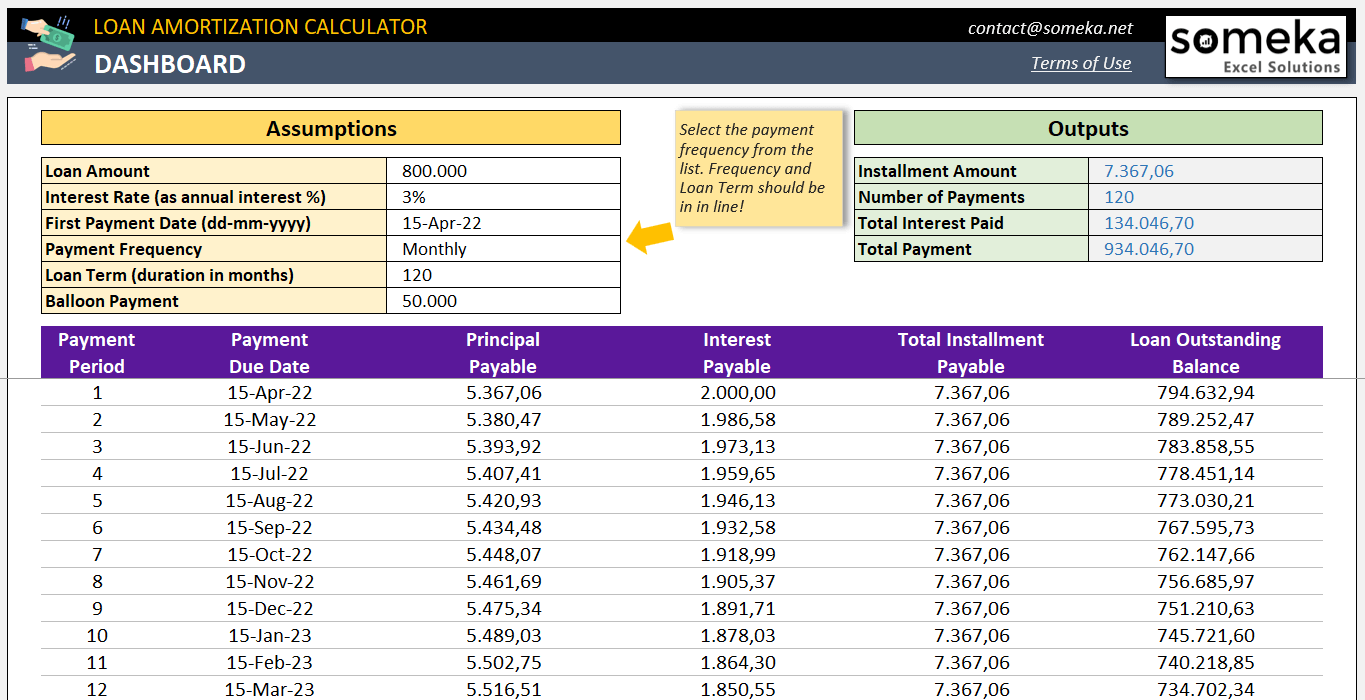

Loan Amortization Calculator Excel Template Payment Schedule

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

Free Interest Only Loan Calculator For Excel

Time Value Of Money Board Of Equalization

Loan Amortization Calculator Excel Template Payment Schedule

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

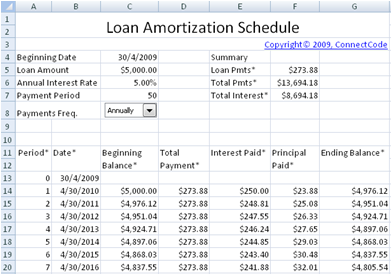

Free Loan Amortization Schedule